philadelphia property tax rate 2019

091 of home value. Get Real Estate Tax relief.

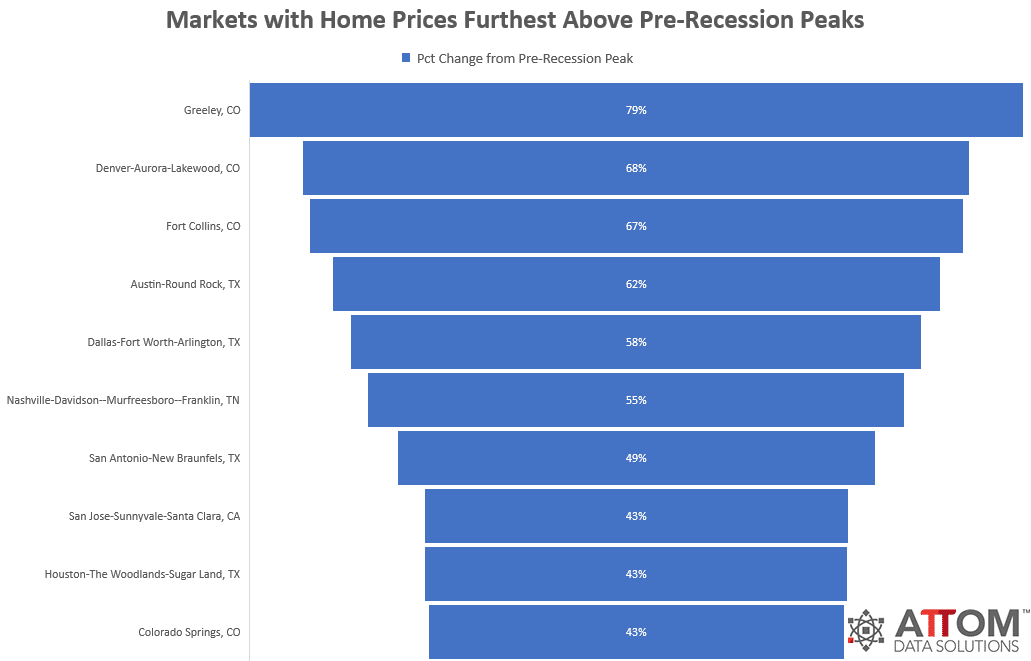

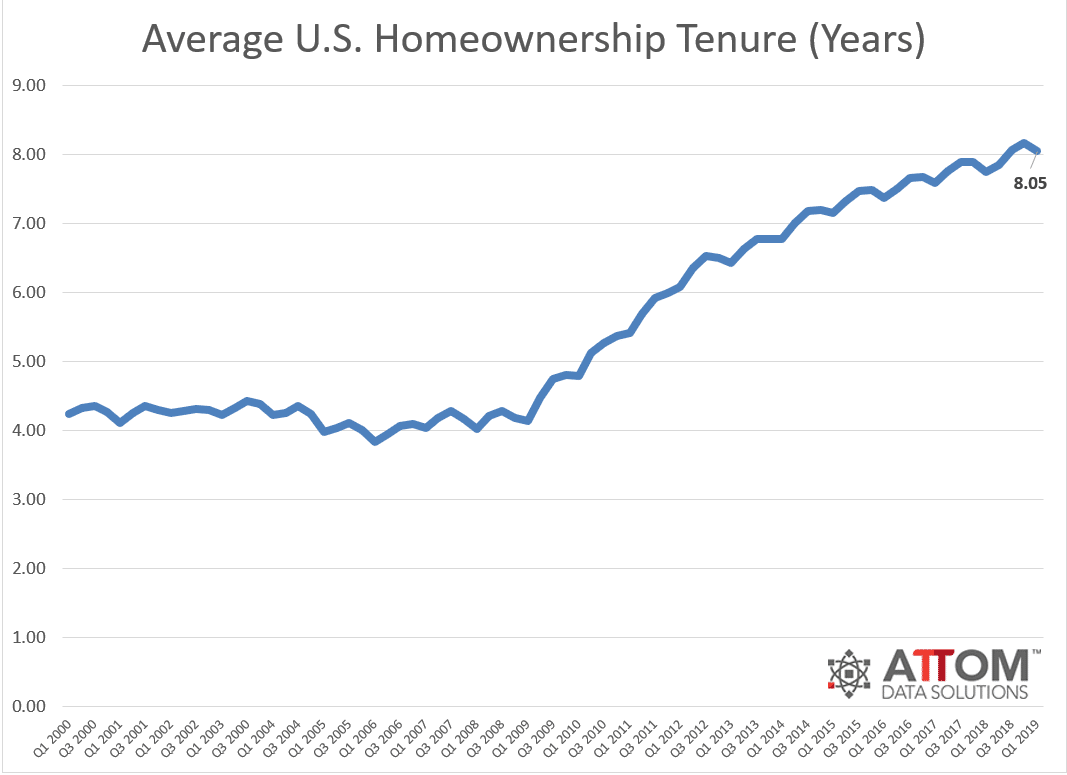

U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom

City of Philadelphia.

. Get Real Estate Tax relief. Oct 11 2019. Restaurants In Matthews Nc That Deliver.

Philadelphia performs well for commercial property tax rates compared to other cities in the nation according to a recent report. The citys current property tax rate is 13998 percent. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances.

Philadelphia Property Tax Rate 2019. Tax bills for nearly half the blocks homeowners will jump from around 1000 to close to 2000 or more. For example if your property is assessed at a 250000 value your annual property tax will be about 3497.

That rate applied to a home worth 239600 the county median would result in an annual property tax bill of 5075. If you receive a property tax abatement are enrolled in LOOP or. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Find more information about philadelphia real estate tax including information about discount and assistance programs. As a result her tax bill will have increased from 1963 to 2445 between 2018 and 2020. Then in early July 2017 wed gotten another notice.

Heres how to calculate your new tax bill. Nisenfelds property assessment or the value used to calculate real estate tax bills increased 149 percent this year. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

Soldier For Life Fort Campbell. To get started you can. Philadelphia Property Tax Rate 2019.

Yearly median tax in Philadelphia County. You can also generate address listings near a property or within an area of interest. The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home.

On Bonapartes block around Norris Square median property valuations skyrocketed 104. 13 hours agoSeveral areas of South Philadelphia could see significant increases to their property taxes due to the citys latest reassessment which will go in effect for 2023. Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania.

Pennsylvania is ranked 1120th of the 3143 counties in the United States. Majestic Life Church Service Times. By David Murrell.

Residential Property Taxes Likely. The City of Philadelphias tax rate schedule since 1952. The City of Brotherly Loves rate of 11 places it.

How a Philadelphia Property Tax Issue Nearly Cost Us Our House. Select a location on the map. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to calculate next years tax bills.

At this value paying before the last day in February will save you around 35. Use the Property App to get information about a propertys ownership sales history value and physical characteristics. For example philadelphia was considering a 41 property tax increase for 2019.

The citys last reassessment came in 2019 when property values increased about 10 percent on average citywide. The countys average effective property tax rate is 212. All real estate located in Philadelphia is assessed by the city of Philadelphias Office of.

Report a change to lot lines for your property taxes. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Phillys 2020 assessments are out.

Coronavirus Disease 2019 COVID-19 Get services for an older adult. So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new property assessments for 2019. Heres a basic formula.

Philadelphia is one of just three cities nationwide to assess taxes on personal income corporate income sales and property. Phillys 2020 assessments are out. The Office of Property Assessment OPA determines the value of.

Heres how to calculate your new tax bill. Philadelphia property taxes 2019. Get a property tax abatement.

Please note that the tool below only provides an estimate. 2019 at 0118 PM. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Get a property tax abatement. However if you pay before the last day of February you are entitled to a 1 discount. The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate.

That increased by an additional 31 for the last reassessment which was completed in 2019 and used for 2020 and 2021 tax bills. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

Sexual health and family planning. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. Opry Mills Breakfast Restaurants.

The citys current property tax rate is 13998 percent. Report a change to lot lines for your property taxes. Essex Ct Pizza Restaurants.

The city of brotherly loves rate of 11 places it. Philadelphias new property reassessment its first in three years bumps up residential property values 31 on average citywide but an Inquirer analysis of assessment data found that residents in some rapidly developing areas could see hikes three to eight times that. The state income tax rate for 2019 is 307 percent 00307.

December 17 2021. We owed 731 in Net Profits Tax a business tax plus 5117 in penalties and interest. This round of reassessments yielded an average of a 31.

It will increase by an additional 98 percent next year according to the 2020 property assessments released this month. Income Tax Rate Indonesia.

Digital Currency Was In Computer Industry For 20 Years Send2press Newswire Memory Module Computer Memory 20 Years

U S Foreclosure Activity In October 2019 Climbs Upward From Previous Month Attom

Get The Right Mortgage With Florida S Largest Mortgage Lenders Mortgageflorida Tk Lowest Mortgage Rates Mortgage Rates Mortgage Lenders

For A Roof In Old Westbury N Y A Singular Slate From England Published 2019 Old Westbury Westbury Roof Restoration

America S Formerly Redlined Neighborhoods Have Changed And So Must Solutions To Rectify Them

U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom

Opioid Misuse And Overdose Data Department Of Behavioral Health And Intellectual Disability Services City Of Philadelphia

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom

Several Tax Changes In 2019 To Affect Buy To Let Property Choosing A Career Entrepreneur Academy Education Related

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Sovereign Wealth U S Buying Binge May End Soon Despite Tesla Realestatenews Realestatetips Realestate Investor Mo Mortgage Tips Mortgage Mortgage Brokers

Philadelphia County Pa Property Tax Search And Records Propertyshark

Philly S Finances Are On The Mend As City Passes 2020 Budget Philadelphia 3 0

Commercial Real Estate Market Sees Continued Price Appreciation In 2019 Fs Investments

America S Formerly Redlined Neighborhoods Have Changed And So Must Solutions To Rectify Them

March Madness 2019 Real Estate Edition March Madness College Basketball Teams Real Estate